The Impact of Data Valuation on M&A Deals: A Guide for Business Leaders

- elizabethcameron5

- Mar 5, 2025

- 3 min read

In today’s fast-paced digital economy, data is no longer just numbers on a spreadsheet - it’s a powerful asset that shapes the future of business. Companies that harness their data effectively are emerging as key players in mergers and acquisitions (M&A), attracting investors and buyers eager for actionable insights. This shift is driving higher valuations and better deal outcomes for data-driven businesses.

This article explores the growing role of data in M&A, key trends shaping the landscape, and what business leaders need to know to stay competitive.

The Evolving Role of Data in M&A

Traditionally, M&A decisions were driven by physical assets and financial performance. However, the digital revolution has reshaped this approach. Today, data is recognised as a strategic asset with immense potential. Companies that can analyse customer behavior, market trends, and operational efficiencies are now among the most sought-after acquisition targets.

A 2022 PwC report found that businesses with strong data analytics capabilities saw their M&A valuations increase by an average of 25%. This underscores a fundamental shift: it’s no longer just about the volume of data a company holds, but how effectively it can leverage that data to drive business decisions.

Buyers Prioritising Data-Rich Companies During Due Diligence

As M&A due diligence evolves, buyers are placing greater emphasis on the quality and relevance of a target company’s data assets. They want to understand how well a company’s data drives decision-making, improves efficiency, and enhances customer engagement.

Consider the case of a tech firm acquired for $300 million - its advanced analytics capabilities and deep customer insights were major factors in the buyer’s decision. Similarly, a recent study revealed that 68% of acquirers believe that a target’s data quality directly correlates with its long-term value.

By thoroughly assessing a company’s data landscape, buyers can uncover hidden growth opportunities and potential risks, making informed investment decisions.

Data-Driven Companies Command Higher M&A Multiples

The financial impact of data-driven decision-making is undeniable. Companies that demonstrate advanced data strategies consistently achieve higher M&A multiples compared to their peers.

According to Deloitte, firms that effectively utilise data see M&A valuation premiums of up to 30% higher on average. The ability to present a clear, structured data strategy not only showcases a company’s past success but also highlights its future potential. For business leaders looking to attract investors or acquirers, prioritising data strategy is no longer optional - it’s a competitive necessity.

The Rising Demand for Data-Backed Business Intelligence

As data valuation gains importance, businesses are increasingly investing in tools that transform raw data into actionable insights. Platforms like Tableau and Power BI have become essential for companies looking to integrate data analytics into their operations.

A recent survey found that companies utilising advanced business intelligence tools experience, on average, a 15% boost in operational efficiency. By leveraging data-driven decision-making, organizations can optimise resource allocation, enhance customer relationships, and ultimately increase their appeal to potential buyers.

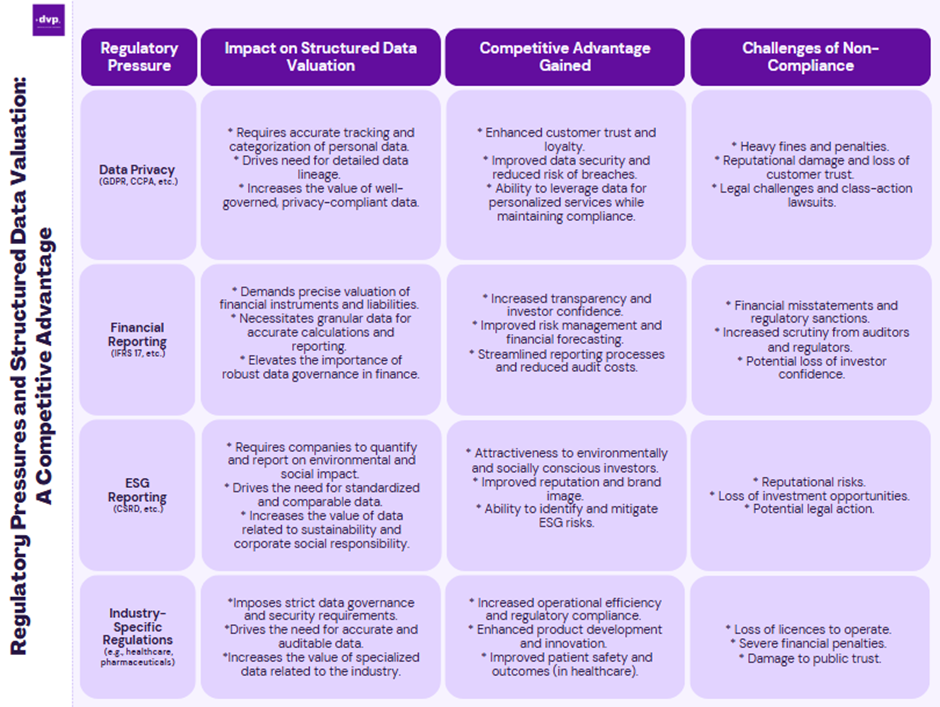

Regulatory Compliance as a Competitive Advantage in M&A

With evolving data regulations such as GDPR and CCPA, data governance has become a critical factor in M&A transactions. Companies that maintain strong compliance frameworks are more attractive to buyers, as they mitigate regulatory risks and ensure data integrity.

A 2023 report highlighted that organizations with robust data governance structures were 40% more likely to achieve successful M&A outcomes. For sellers, this means that strong compliance practices can significantly enhance valuation and expedite deal processes by reducing due diligence concerns.

Integrating Data Valuation into Business Strategy

To succeed in today’s M&A landscape, business leaders must integrate data valuation into their broader strategic planning. Cultivating a data-driven culture across all levels of an organisation enhances its ability to extract value from data and positions it as a strong acquisition target.

By proactively investing in data analytics, governance, and compliance, companies can differentiate themselves in competitive markets. This strategic focus not only enhances M&A prospects but also drives long-term growth and operational excellence.

Conclusion

The role of data in M&A is more critical than ever. As businesses navigate an increasingly data-centric world, understanding and leveraging data valuation can be the key to unlocking greater investment opportunities and achieving premium valuations.

To stay ahead, companies must:

Emphasise data quality and analytics capabilities during due diligence.

Invest in business intelligence tools to drive efficiency and insight.

Prioritise data governance and compliance to reduce regulatory risks.

Integrate data valuation into their overall business strategy.

Incorporating a strong data strategy isn’t just about maximizing M&A value - it’s about future-proofing your business for long-term success in an evolving marketplace. Companies that embrace this shift will not only attract investors but also secure a competitive edge in today’s data-driven economy.

Comments