Data Wins the Trade War: Turning Tariffs into Business Gold

- elizabethcameron5

- Mar 18, 2025

- 3 min read

With uncertainty surrounding US trade policy, businesses are closely watching potential tariff changes on imports from Mexico and Canada. While some tariffs remain in place, others have been lifted, and new ones have been threatened but not yet enacted. As of today, it remains unclear whether the US will impose new 20% tariffs on key imports, leaving businesses in a precarious position. The lack of clarity is already causing ripple effects across supply chains, from delayed procurement decisions to increased demand for real-time supply chain data.

Supply Chain Tariffs: A Data Asset Value Shift

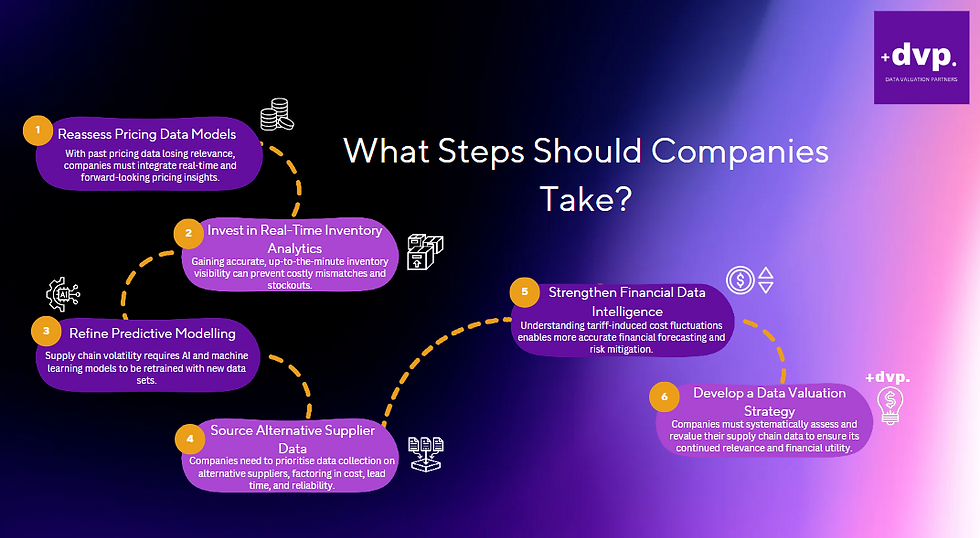

Trade uncertainty is not just a logistical headache - it’s a direct challenge to the value of supply chain data. With shifting tariffs, historical pricing data loses relevance as cost structures fluctuate. Real-time inventory tracking becomes a critical asset, helping businesses navigate supply shortages and demand surges. Predictive models that once provided reliable forecasts must be reengineered to factor in political and economic volatility. Alternative supplier data is more valuable than ever, as companies seek to diversify their sourcing strategies to mitigate risks.

This isn't just about logistics; it's a financial data reckoning. Businesses that fail to reassess the value and application of their data may find themselves making decisions based on outdated or incomplete information.

The DVP Perspective: Data as a Competitive Lever

At Data Valuation Partners, we view data as a dynamic financial asset - one that must be continuously reassessed in light of geopolitical and economic changes. The ongoing trade uncertainty highlights the reality that businesses must build flexible, data-driven strategies that allow them to pivot quickly in response to new developments.

For instance, companies that leverage real-time data valuation models can proactively identify risks and opportunities, rather than reacting after the fact. Businesses that monitor alternative supplier costs and lead times through data analytics are better positioned to secure competitive contracts before shortages hit. Those that integrate real-time pricing intelligence into their forecasting models can protect their margins while competitors struggle to adapt.

In a world where tariff policies remain in flux, companies that treat data as an evolving financial asset will have a strategic advantage.

Contemporary Geopolitical Considerations

The trade environment is shifting rapidly. Over the past year, we have seen tariffs on certain steel and aluminum imports lifted, while new threats of tariffs on automotive and agricultural goods from Mexico and Canada have emerged.

Meanwhile, previous tariff disputes with China continue to impact global supply chains, driving companies to reassess supplier relationships and distribution networks.

In parallel, the European Union’s evolving carbon border adjustment mechanisms are adding another layer of complexity, requiring businesses to collect and analyse emissions-related supply chain data. The recent tightening of semiconductor export restrictions also underscores the need for businesses to evaluate their data strategies in real time.

The Future of Supply Chain Data Valuation

As trade policy uncertainty continues, businesses that proactively adjust their data strategies will gain a competitive edge. Those that don’t risk being left behind in a landscape where data value is more fluid than ever.

At DVP, we help organisations unlock the financial potential of their data assets. The current trade situation is a prime example of why companies need robust data valuation frameworks that allow them to react swiftly to external shocks. Data isn’t static - it’s an evolving asset. Businesses that understand its changing worth will be better equipped to navigate uncertainty and emerge stronger.

For companies looking to navigate the data challenges of trade uncertainty, now is the time to invest in data valuation. The right insights today will define tomorrow’s market leaders.

Comments